In 2021, a generator was stolen from a home construction site in Eureka, Missouri. The $10,000 industrial generator was bolted to a slab of concrete, but the thief cut through the bolts. It was never recovered.

Every year, $1 billion worth of equipment is stolen from construction sites. Loaders are the most common type of equipment stolen, but theft can range from expensive tools to towables such as generators.

Inland marine insurance protects your business if your equipment is stolen or damaged while in transit or on a job site. Who needs an inland marine policy and what does it cover?

In this guide, we’ll explore:

- What is inland marine insurance?

- What does inland marine cover?

- Who needs an inland marine policy?

- How much does inland marine insurance cost?

- How telematics impact your inland marine insurance

- How to get inland marine coverage

- The inland marine claim process: What to expect

- Get the inland marine coverage you need from a partner you trust

What is inland marine insurance?

Inland marine insurance coverage provides financial protection for a business’s property while transported on land or stored in a temporary location. It’s used to protect equipment, tools, materials, and technology.

Since these items are often not covered by standard property insurance policies, inland marine can help protect your business from loss.

Why is it called inland marine coverage?

Despite its name, inland marine insurance has nothing to do with marine transportation or shipping. The name comes from the original marine insurance policies protecting goods transported over water.

Over time, the coverage expanded to include items transported on land, and the name inland marine stuck.

What does inland marine insurance cover?

Inland marine coverage includes a wide range of valuable items and property in transit. Our clients use this type of coverage for construction equipment, expensive technology, and more.

If these items are damaged or stolen, your inland marine policy can cover repair and replacement. It may also cover business interruption and extra expenses you incur as a result of the damage.

Some examples of the types of damage covered are water damage, theft, and physical damage from a vehicle accident or other collision.

What isn’t covered by inland marine?

Inland marine typically does not cover:

- General liability for bodily injury, property damage, and personal injury

- Regular wear and tear over time

- Intentional acts of damage or theft committed by you or your employees

- Vehicles and auto liability (you still need commercial auto insurance too)

What is and isn’t covered can vary, so it’s important to be familiar with your specific policy details. At POWERS, we go through a thorough assessment with all clients to ensure the policies they buy fit the risk they face.

Inland marine vs. general liability insurance

Inland marine insurance is a type of property coverage, while general liability insurance is liability coverage. Many businesses benefit from having both types of policies.

Inland marine has a specific purpose: protecting your property while in transit. If your items are damaged, you can file a claim.

General liability protects you against liability for claims of bodily injury, property damage, and personal injury. If someone makes a claim against your business, GL will cover your legal costs.

Inland marine vs. mobile equipment insurance

Mobile equipment insurance is specific to non-motor vehicle equipment like forklifts and excavators. Inland marine covers a wide range of equipment, materials, and products.

Both types of insurance are common on construction projects, but inland marine often includes a broader range of covered property.

Does inland marine have cargo coverage?

Yes, inland marine typically includes cargo coverage that protects goods or merchandise in transit.

What’s the difference between cargo and inland marine insurance?

Cargo is a specific type of inland marine insurance. This coverage protects goods and merchandise – whether it’s yours or someone else’s.

Inland marine is more general and covers your own equipment and cargo being transported or stored in a temporary location.

Does inland marine cover stored materials?

Yes, inland marine covers materials and equipment while stored temporarily at a job site or warehouse.

Some policies have exclusions for the following:

- Equipment that’s not properly stored or secured

- Equipment that’s leased or rented to others

- Excluded materials such as hazardous or toxic substances

- General depreciation or wear and tear.

Is inland marine the same as equipment floater?

Inland marine and equipment floaters are similar but not exactly the same. Inland marine insurance is a broader category of coverage for property during transportation.

An equipment floater is a type of inland marine policy that covers specific, high-value items like construction equipment or specialized tools.

Inland marine is more general while an equipment floater is for specific equipment.

Who needs an inland marine policy?

Any business that transports equipment and materials, or stores them at an off-site location, can benefit from an inland marine insurance policy.

Here are some industries that commonly need inland marine

- Construction. Builders and contractors often transport valuable construction tools, equipment, and materials to job sites.

- Independent contractors and subcontractors. Professionals like plumbers, electricians, and landscapers frequently move equipment from one location to another.

- Technology firms. These companies often transport expensive systems like servers and networking equipment to different client locations.

- Healthcare. Medical equipment suppliers transport expensive equipment to facilities or patients’ homes.

If you’re unsure whether inland marine is right for your business, consider working with a risk advisor to perform a comprehensive exposure analysis for your business. You might be exposed to risk you haven’t considered.

Inland marine insurance for construction

Inland marine is particularly important in the construction industry because of its widespread need to transport valuable equipment and materials to different job sites.

Here are a few of the most common use cases we see for inland marine in construction:

- Equipment and tools. The value of even a small company’s cranes, bulldozers, excavators, and specialized power tools can easily rise into the tens of millions. While they’re transported, they may be exposed to various risks that aren’t covered by a traditional commercial property policy.

- Building materials. Materials like lumber, steel, cement, and fixtures are susceptible to damage during transit, whether from accidents, weather, or theft.

- Rented or leased equipment. Many construction businesses regularly rent or lease equipment. Inland marine can provide additional coverage where commercial property may not.

- Subcontractors’ equipment. Inland marine can also cover losses or damage to subcontractors’ equipment on your job site, reducing potential disputes and liabilities.

How much does inland marine insurance cost?

Insurance companies calculate your inland marine premium using several factors, such as:

- Types of property and equipment

- Coverage limits and deductibles

- Risk factors

- Loss history

Because business insurance rates can vary, it’s important to work with a risk manager to find the best solution. Businesses with complex risk profiles will find the most value from partnering with an independent insurance agent that will help them proactively manage risk for long-term success.

More on the benefits of integrated risk management. >

How telematics impacts your inland marine insurance

These days, we can’t talk about insuring heavy equipment without talking about telematics.

Telematics technology allows businesses to monitor and track equipment’s location, usage, and performance in real-time. In addition to helping your operations run more smoothly, this data visibility can have several impacts on your inland marine insurance:

- Claim prevention. Telematics enables better risk management by identifying hazards and reducing the likelihood of accidents or theft during transportation.

- Asset recovery. If your equipment is stolen, real-time GPS tracking can help law enforcement locate and recover. This minimizes financial losses on any associated claims.

- Claims verification. Telematics provides objective information about your equipment’s location and condition at the time of an incident. This can expedite claims processing.

- Operator monitoring. Devices allow for controlled operator access and monitored operator behavior. By promoting safe operating habits, you can reduce your risk of accidents and damage during use.

- Lower premiums. Some insurers offer discounts to businesses that use telematics on their equipment. Monitoring equipment usage demonstrates proactive risk management to your carrier.

Get technology-powered discounts on inland marine

Today, technology makes it easier than ever to manage your assets and reduce risk.

We’re pleased to offer POWERS clients access to special discounts of up to 50% on their inland marine policies.

How? It’s simple – we reward safe operators using telematics technology.

Here’s an example:

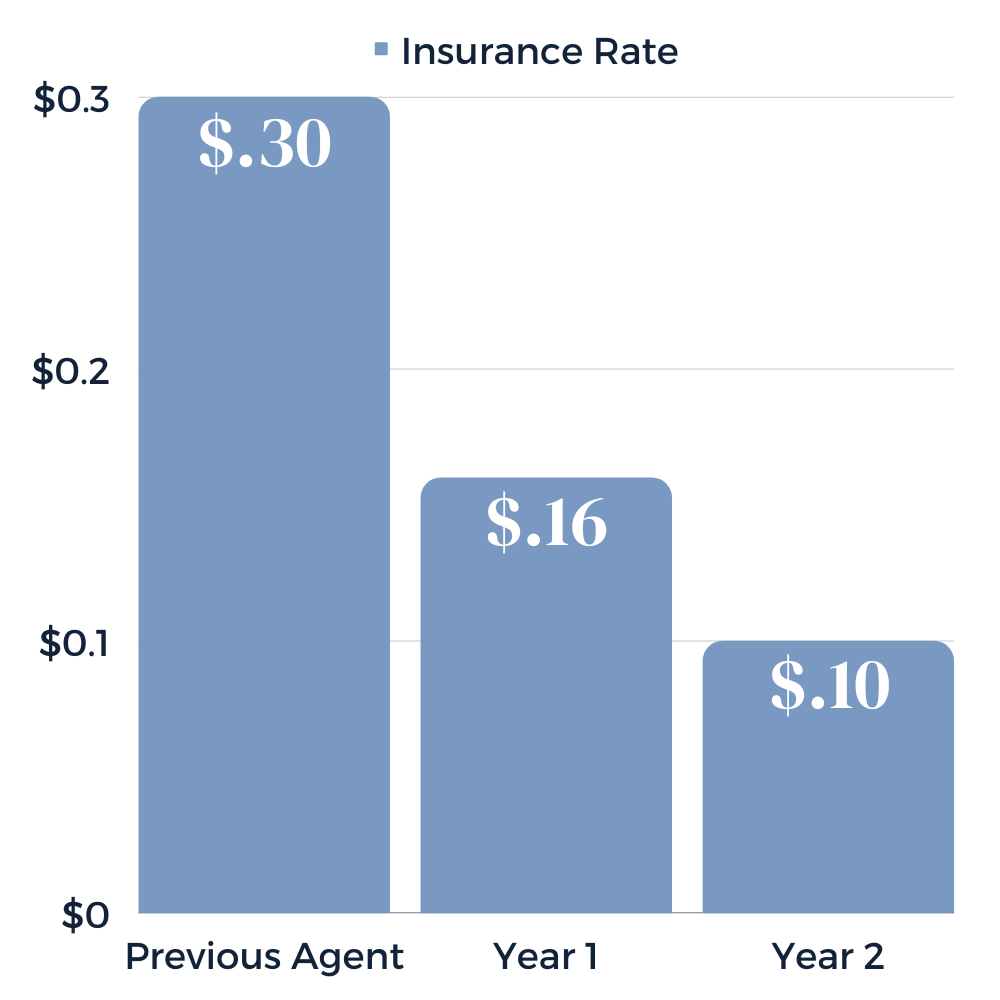

A large construction business approached us to discuss their insurance program. They decided to add telematics tech to 996 pieces of equipment, qualifying them for a proprietary discount of 47% on their inland marine policy.

Their investment in technology boosted productivity and safety – and after 12 months of no losses, we restructured their insurance program again, lowering their rate from $0.16 to $0.10. The bottom line? A 67% reduction in their equipment insurance rate over just two years.

Find out how much you can save by getting a free consultation on our calendar.

How to get inland marine coverage

An experienced agent should recommend insurance policies for you based on your business’s unique exposures and risk profile. If your agent hasn’t recommended inland marine but you think it could be a good fit, ask about it.

Your agent will find the best options based on your risk assessment and present them to you. At POWERS, we cover the following questions when presenting clients with coverage options:

- Does the pricing match the client’s expectations?

- Does the policy have the appropriate limits, deductibles, and coverage enhancement endorsements?

- What are the carrier’s financial stability, reputation, and claims process like?

- What added value can the carrier offer the client – e.g. discounts for using telematics and specialized coverage for certain industries?

At POWERS, we work with some of the best business insurance carriers in the U.S. There’s no need to spend hours researching providers – we’ll make recommendations tailored to your business.

I truly believe these guys are looking out for your best interest and have complete faith and trust in the care they put into what they do for you, researching rates, getting the best coverage for you.

Kraig H. (current client)

The inland marine claim process: What to expect

If you need to file an inland marine claim, don’t panic. Thousands of claims are filed every day.

The claim process is different for every carrier and agency, so we recommend learning your insurance agent’s process before you need to file a claim. That way, you’re prepared when the time comes.

Here’s the claim process for POWERS clients:

- Contact your POWERS account manager or claims handler before you call the insurance carrier.

- A POWERS expert will provide a claim consultation to help you evaluate the severity of the claim, your deductible level, contractor referrals, and what to expect going forward.

- With your approval, your account manager will submit the claim to the carrier on your behalf. In some cases, you might choose not to file a claim.

- We’ll pass along your claim number and your adjuster’s contact info.

- You’ll work directly with your adjuster to provide relevant evidence, like photos of the damage, repair estimates, purchase receipts, and police reports if applicable.

- If the loss is covered, the carrier will offer a settlement amount based on its evaluation of the damage.

- Once a settlement is reached, the carrier will provide payment.

During this process, your POWERS claims consultant will be with you every step of the way.

Get the inland marine coverage you need from a partner you trust

Many businesses can benefit from inland marine, but how can you make sure you get the right coverage and the most value from your policy? Who will guide you through the claims process when an incident happens?

Any agent can write you a policy. But you don’t need any agent – you need a business partner with proven risk control expertise.

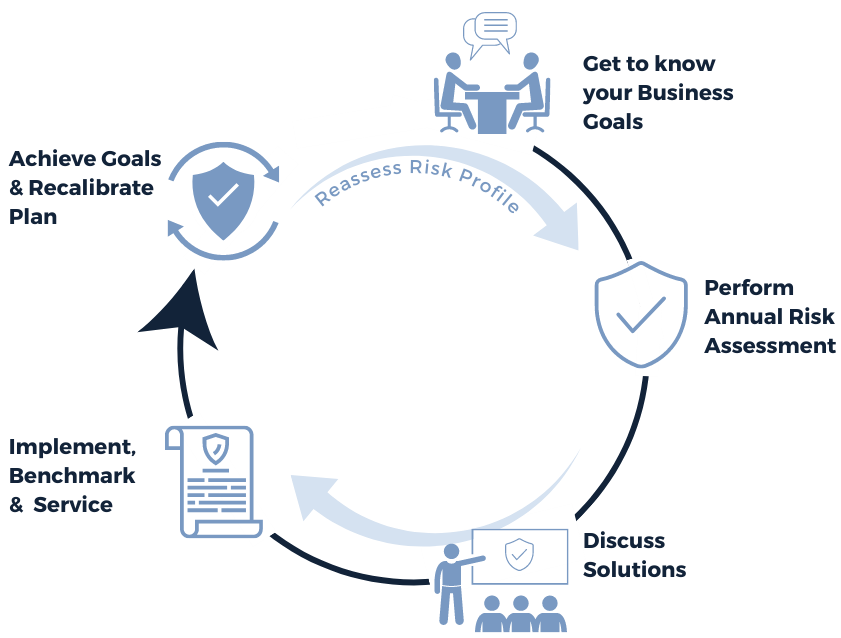

At POWERS, we spent more than 30 years developing what we call “the POWERS Process.” We use this five-step framework to get a deep understanding of your business and make recommendations that not only give you the right insurance coverage, but also help you make smart decisions to grow your business.

We know from decades of experience that a one-size-fits-all approach to risk management simply doesn’t work. We’ll take you through a series of discussion points to drill down and uncover exposures you’ve never considered. Then, we’ll build a plan to safeguard your business and look toward the future.

Schedule your 30-minute consultation today. >

| Anonymous Agency | POWERS |

| Insurance as a stand-alone product | Insurance integrated into your customized risk management plan |

| Multiple, run-of-the-mill applications to assess your risk | Customized, proprietary assessment for a deep understanding of your risk |

| Focused on up-front cost savings | Focused on long-term cost control |

| Salespeople who write your policy and ghost you until renewal | Partners who help you make smart, growth-focused business decisions |

| Say they care about your business’s success | Show you we care by setting your risk management plan in motion |