Looking to secure your Restaurant Business?

That's what we do! You've worked hard to get your restaurant to this point ... now let us make sure circumstances out of your control don't cost you what you've built. When purchasing insurance for your restaurant, we suggest engaging with an agency that will build an insurance and risk management program for your restaurant. It's important to have an advisor that understands the industry and offers the right insurance companies with key coverages... not just "insurance in a box" policies.

Our advisors are known for their real-time availability and on-the-spot advice, which helps our clients feel comfortable knowing they can turn to an expert during a tough situation. Sometimes, we've helped an owner avoid a potential claim altogether. That's when we think we've done our best work.

The risks are always evolving for a restaurant owner -- whether you have just opened your first location or if you are about ready to launch your franchise -- it's nice to know you have an adviser on hand that can give you resources and find quick answers to make your job easier.

For specific details on the lines of coverage that will benefit you the most, be sure to check out our Restaurant Insurance Proper Coverage page. Some of the lesser-known coverage's that are important are: Business Income Interruption coverage that includes up to 12 months of actual loss sustained and a disappearing deductible for utility service interruption; Liquor liability coverage with an unlimited aggregate is a special product offering that can bring peace of mind if you suffer a large claim early in the policy year.

POWERS Insurance and Risk Management has built a strong partnership with multiple insurance companies who specialize in restaurant insurance. That way, we can ensure we are offering the highest quality coverage at a competitive price.

How to get started

The process of getting a Restaurant Insurance quote is simple. You can either call us directly, or click over to our Quotes page to give us a little more information about your situation and needs.

Either way, we'll make the process easy!

Proper Coverage

Check out the key coverage we recommend for most restaurants.

Franchise Information

Make sure your franchise is covered properly from the beginning.

Restaurant Insurance Drive-Thru

Restaurant Insurance basics you need to know at a glance

Restaurant Safety Tips

Some tips and tricks we've learned to keep your business safe.

Proudly Supporting our Hospitality clients through COVID-19

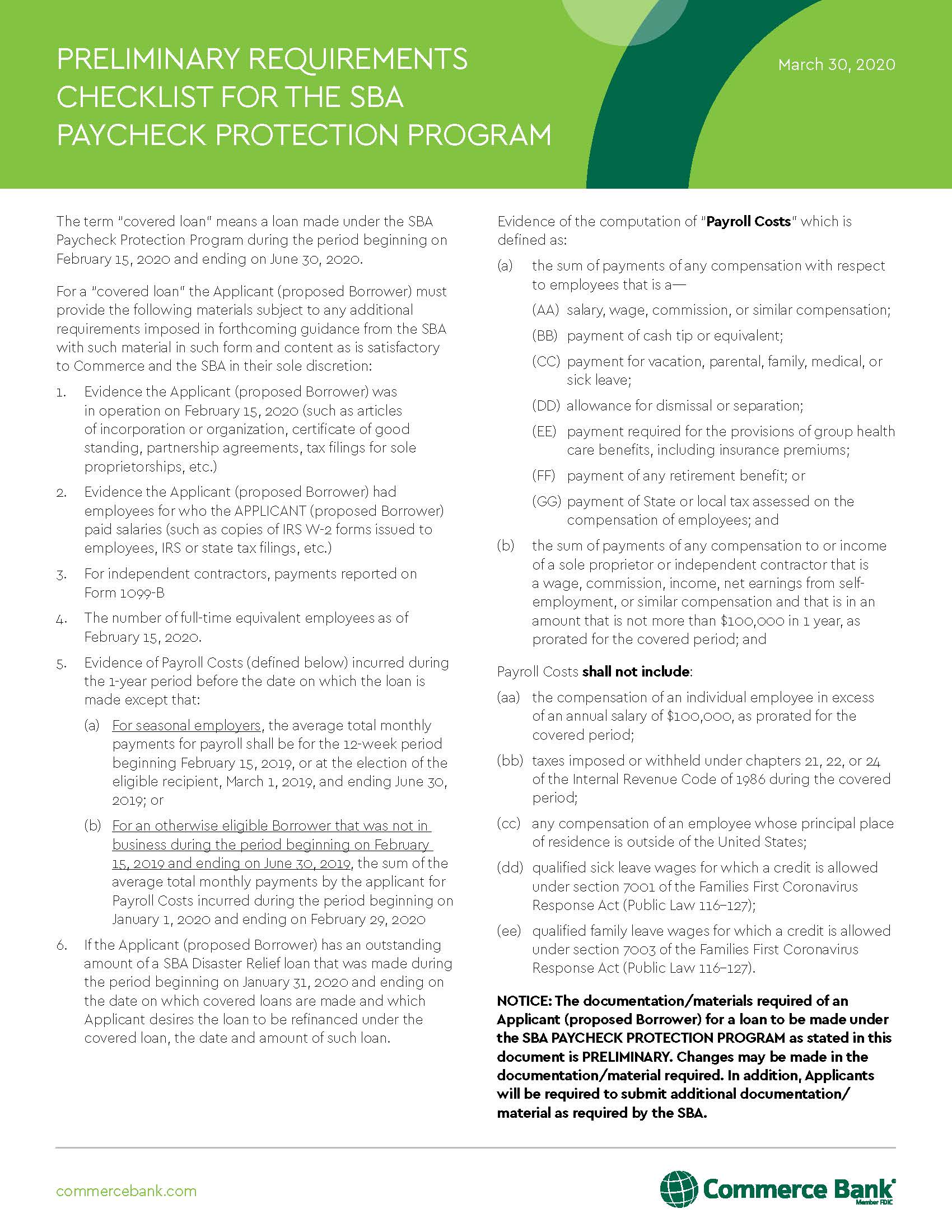

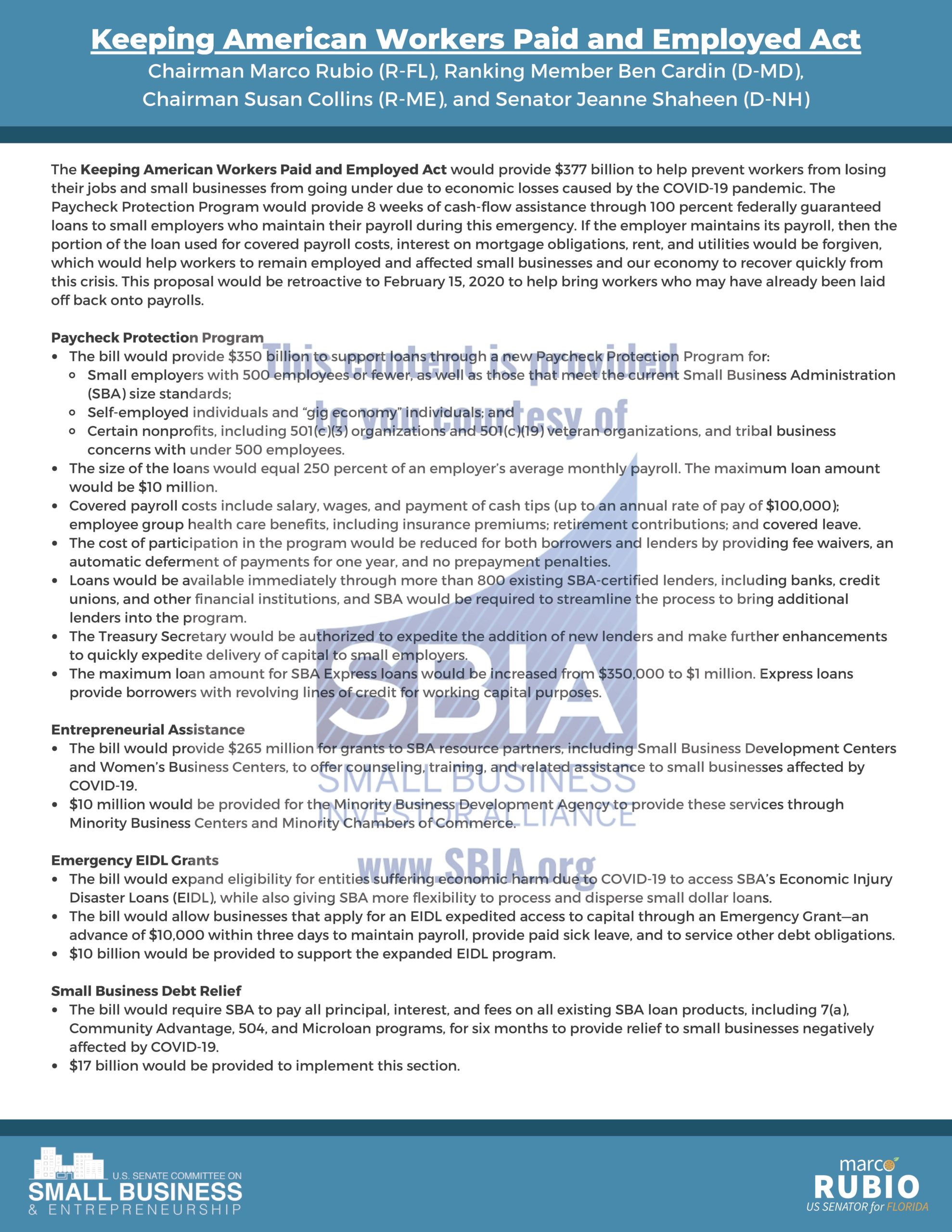

Details are still pending change from the multi-trillion dollar stimulus deal, but here's a quick overview of Small Business Relief efforts the government is providing:

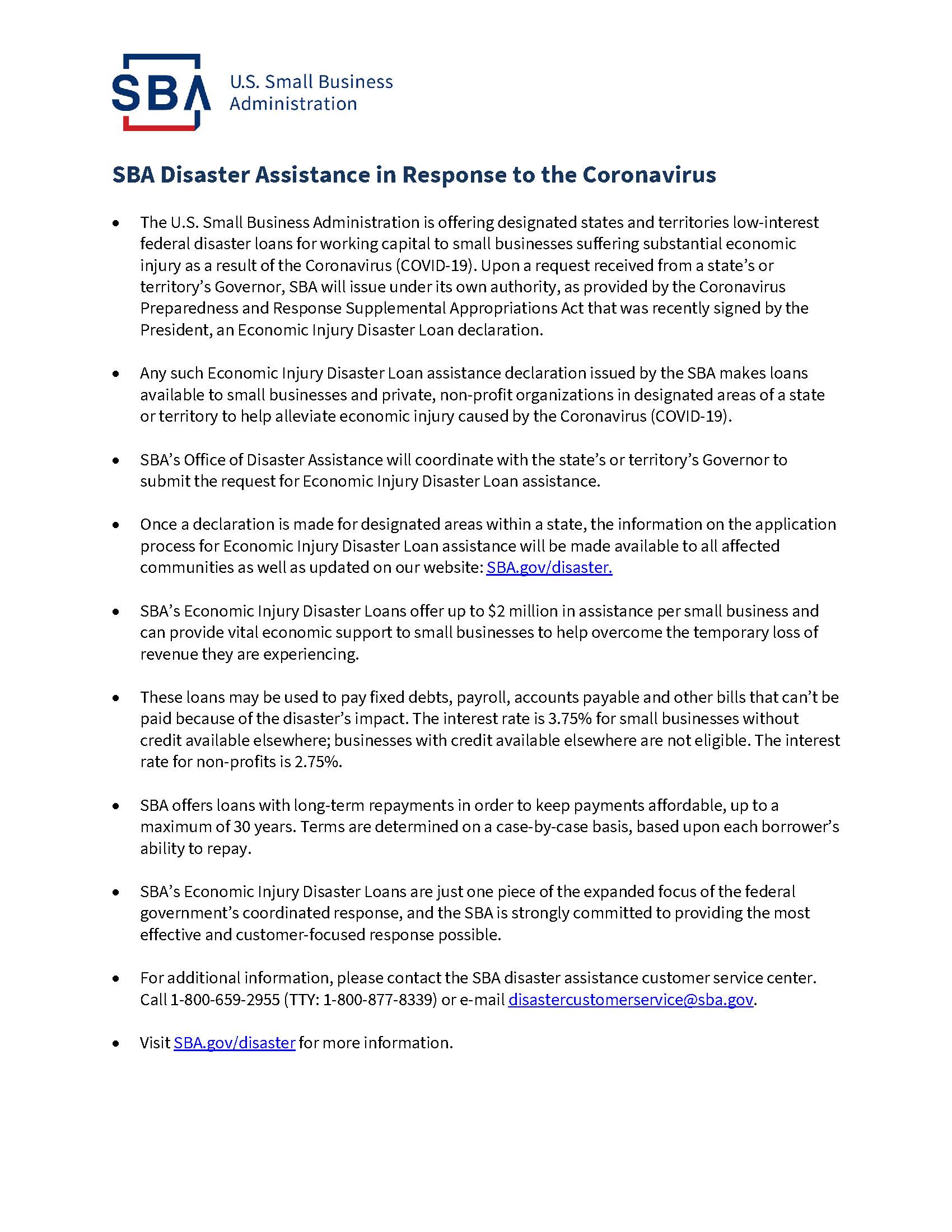

· $350 billion in loan forgiveness grants to small businesses and non-profits to maintain existing workforce and help pay for other expenses like rent, mortgage, and utilities

· $10 billion for SBA emergency grants of up to $10,000 to provide immediate relief for small business operating costs

· $17 billion for SBA to cover 6 months of payments for small businesses with existing SBA loans

o Defines eligibility for loans as a small business, nonprofit, or veteran’s organization with 500 employees, or the applicable size standard for the industry as provided by SBA, if higher

o Allow businesses with more than one physical location and no more than 500 employees per physical location in certain industries to be eligible

o Provides for loan forgiveness equal to the amount spent by the borrower during an 8-week period after the origination date of the loan on payroll costs, interest payment on any mortgage incurred, payment of rent on any lease in force, and payment on any utility for which service began prior to February 15, 2020

§ Amounts forgiven may not exceed the principal amount of the loan

§ The amount forgiven will be reduced proportionally by any reduction in employees retained

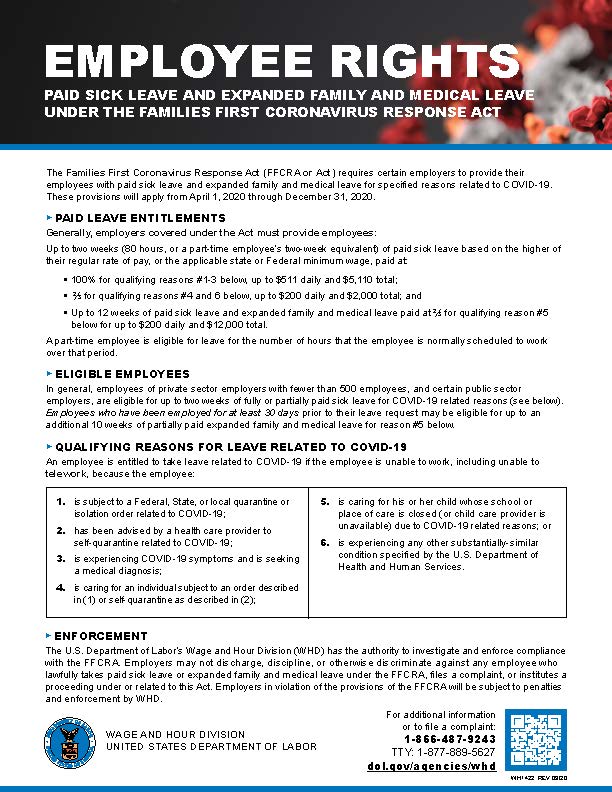

o Covered loans can be also be used for costs related to the continuation of group healthcare benefits, during periods of paid sick, medical or family leave, and insurance premiums

· $1.5 billion for economic adjustment assistance to help revitalize local communities after the pandemic—can be used to help rebuild impacted industries such as tourism or manufacturing supply chains, capitalize local funds to provide low-interest loans to businesses of all sizes, and support other locally-identified priorities for economic recovery

Expanded Unemployment Insurance & Funding

· Creates a “Pandemic Emergency Unemployment Compensation” program that provides for 4 additional months of unemployment insurance, a $600 increase in benefit allotment resulting in $1,200 total benefit, and allows part-time, self-employed and gig economy workers to access UI benefits

Relief for Individuals

- Direct to individual payments of up to $1,200 per individual and $500 per child, subject to income levels under $75k, paid out in the form of tax rebates

- Payroll tax deferral – 50% of payroll taxes for remainder of the year will not be due until January 1, 2021

- Provides income tax exclusion for individuals who are receiving student loan repayment assistance from their employer, effective immediately upon passage of this law through Jan 1, 2021.

- This covers direct to employee payments as well as payments to lender, including principal and interest, on any qualifying education loan.

- Waives the 10-percent early withdrawal penalty for distributions up to $100,000 from qualified retirement accounts for coronavirus-related purposes

Exchange Stabilization Fund

- An “Exchange Stabilization Fund” in excess of $500 billion to provide an economic stimulus for passenger and cargo airlines, businesses critical to national security, and additional reserved funding for sectors disproportionately impacted by the virus

o Caveats to Treasury administered financing include limits that ban stock buybacks for the term of the government assistance plus 1 year on any company receiving a government loan from the bill, employee retention thresholds to limit layoffs, and a cap on executive compensation

Increased Funding & Protection for Health System and Workers

- $200 billion + in increased aid for healthcare workers and medical facilities and support to state and local governments in fighting off this pandemic

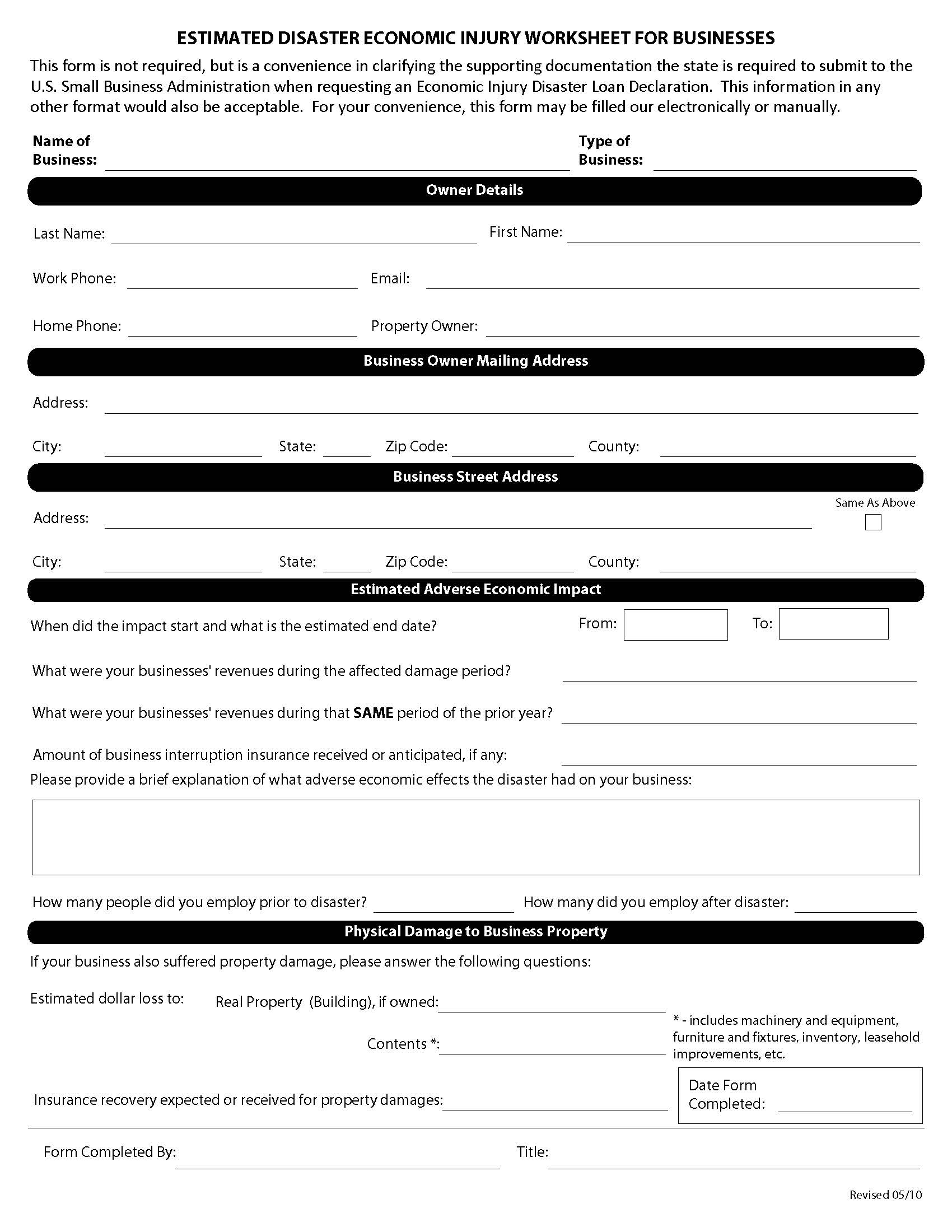

SBA Disaster Relief Information

Our Program Companies

Although this isn't an all-inclusive list of the insurance companies we represent, below are some of the companies we most frequently partner with for restaurant insurance.