If you work in construction or on government contracts, you might be familiar with bonds. Securing a bond is part of doing business – but it’s also an opportunity for you to build your reputation and achieve strategic growth.

Surety bonds provide financial assurance for both the obligee requiring the bond and the principal obtaining the bond. They can increase your credibility and the competitiveness of your bids.

How do bonds work and how can you use them to grow your business?

In this guide, we’ll cover:

- What is a surety bond?

- The importance of contracting with a reputable bonding company

- What’s the difference between a surety bond and insurance?

- Which industries need surety bonds?

- What are the types of surety bonds?

- How surety bonds help you grow your business

- What bonding capacity is and how to increase it

- How to get a surety bond

- How much does a surety bond cost?

- What happens if your business defaults on a surety bond

- Grow your business with a better bond strategy

What is a surety bond?

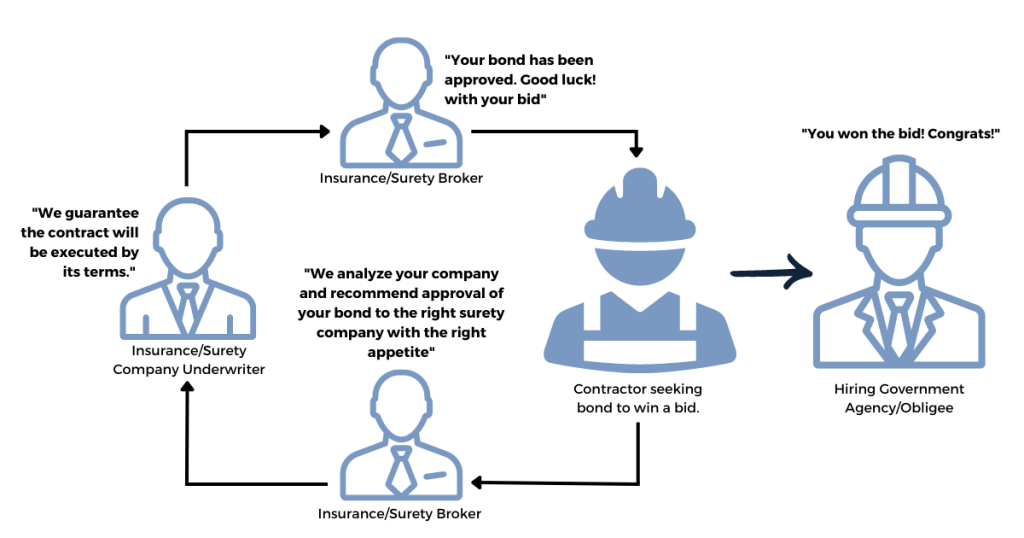

A surety bond is a contract involving three parties: the surety, the principal, and the obligee. The surety guarantees the principal’s performance to the obligee in the contract. If the principal (you) fails to perform according to the contract terms, the surety will step in to fulfill your obligation.

In this event, the surety provider will expect to be made whole via the indemnity agreement, which is both a corporate and personal guarantee from you to the surety.

Surety bonds are typically required for any company working on government contracts. Private contracts in sectors like construction, agriculture, and transportation also sometimes require bonds.

What are surety bonds used for?

A surety bond has two main functions: prequalification and protection in case of default.

In some industries, businesses require bonds as part of a project’s pre-qual process to help them weed out unqualified bidders. Companies that can’t (or won’t) get the appropriate bonds during bidding are unlikely to be good candidates for the project.

Once the partnership is underway, bonds act as financial guarantees that the work will be completed on time and within the parameters of the contract. In many industries, a bond is as important as a business license. It protects all parties and builds trust between you and your clients.

The importance of contracting with a reputable bonding company

Choosing a bonding company is as important as choosing an insurance carrier. As a business owner, you need peace of mind that the provider you choose has the financial strength to back the contract.

For this reason, partnering with an A-rated carrier for your surety bond is essential. Standardized rating agencies evaluate and grade surety carriers for financial stability. This means they have the resources to pay out claims in case of default on the bonded project by the contractor.

Buying a bond from a non-rated surety company can be cheaper but may lead to headaches down the line. And since the whole purpose of a surety bond is to protect your company and clients, there’s no good reason not to choose an A-rated carrier.

At POWERS, we have close relationships with the best A-rated carriers, and they’re all we recommend for our clients. Our specialized surety bond underwriter and service manager can help you make sure you have the right bond from the right carrier.

What’s the difference between a surety bond and insurance?

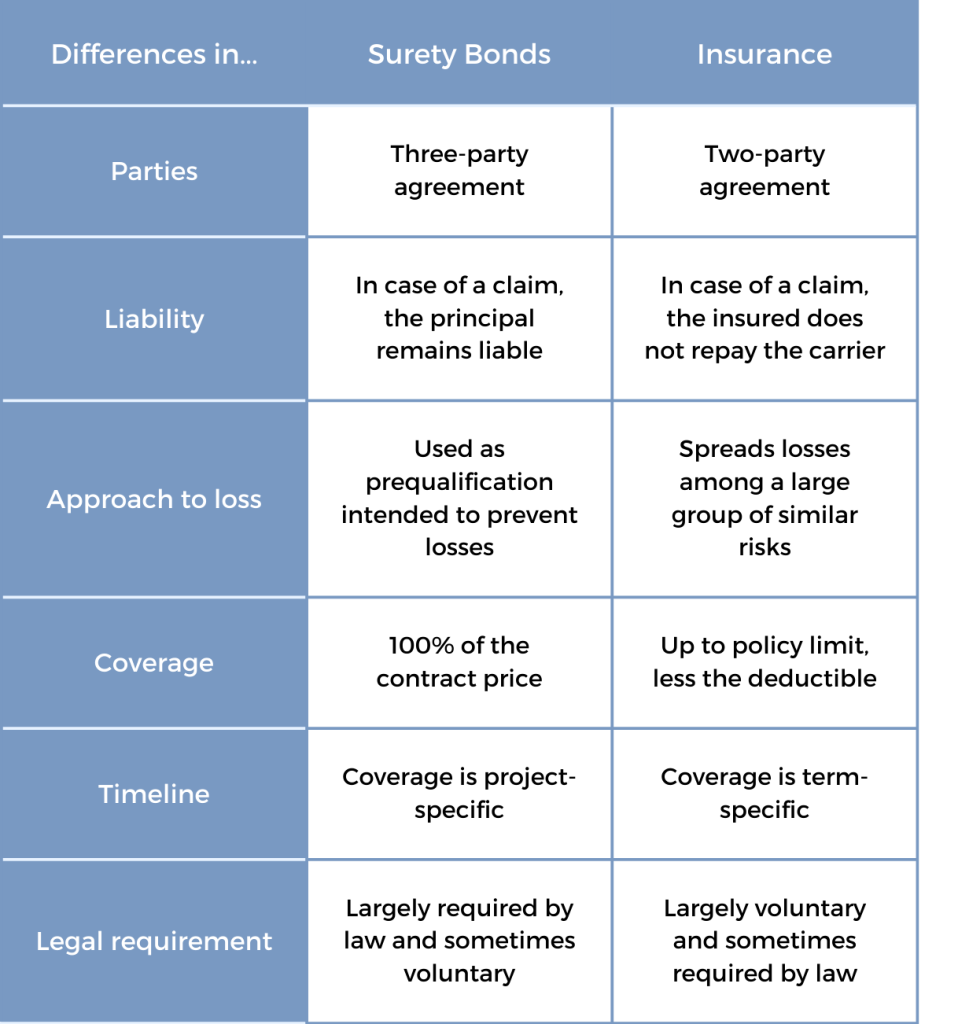

While a surety bond is sometimes referred to as “bond insurance,” there are several significant differences between bonds and insurance. Both are regulated by state insurance departments, but getting a bond is more like securing bank credit than buying a policy from an insurance company.

Here are the main differences between bonds and insurance:

In short, when a surety bond pays out, it’s more like a loan than an insurance claim. The purpose of a surety bond is to protect the obligee. Most often, this means ensuring that laborers and suppliers are paid for work and materials. If a claim is filed, the principal is still on the hook for financial losses – the surety company just pays the obligee up front.

Which industries need surety bonds?

A bond is a versatile risk management tool used in a variety of industries. In some sectors, bonds are legally required for certain types or scales of projects. Here are some of the industries and business types that commonly use surety bonds:

- Construction. Contractors often must get contract bonds to show clients that they’re financially stable and guarantee the successful completion of a project.

- Government contracts. Public entities like municipalities often require contractors performing work for them to have surety bonds.

- Transportation. Freight companies shipping goods across state lines in the U.S. often have surety bond requirements.

- Motor vehicle. Car dealerships and registration organizations are usually required by state Department of Motor Vehicle regulations to have bonds. A common example is auto dealer bonds.

- Large-scale service providers. Companies that contract out janitorial, housekeeping, or gardening services to large clients like hospitals might need to be bonded.

Within each industry, there are many different types of surety bonds. For example, within transportation, there are freight broker bonds, overweight/oversize permit bonds, passenger carrier bonds, and more. It all depends on the services you provide and the clients you serve.

What are the types of surety bonds?

There are dozens of types of bonds for specific situations, but we can divide them into two primary categories: contract bonds and commercial bonds. Let’s take a look at both.

Contract bonds

Contract surety bonds are bonds written for construction projects. What types of projects require bonds? Bonds are required by federal, state, and local governments for construction contracts valued over certain amounts.

The Miller Act specifies federal requirements, and each state has a “Little Miller Act” governing state contracts. While not mandated, private owners and general contractors may also choose to require surety bonds as a risk mitigation tool.

Bonds assure the project’s stakeholders – typically, the taxpayers who have already funded the project – that the project will be finished and everyone will be paid for their work.

As a contractor, bonds enable you to bid on and win larger jobs – and therefore, grow your business.

The types of contract bonds are:

- Bid bonds protect the obligee if a bidder wins a contract but fails to sign the contract or provide the necessary additional bonds. Bid bonds help screen out unqualified bidders since a surety will not issue a bond to a contractor it believes can’t fulfill the contract.

- Performance bonds guarantee the completion of a project according to contract terms if the principal fails to fulfill the contract terms.

- Payment bonds ensure that subcontractors and suppliers are paid for labor and materials if the principal fails to make payments.

- Maintenance bonds (also called warranty bonds) protect the project owner against defects in workmanship for a specified period of time after completion.

- Supply bonds guarantee the delivery of supplies and materials for a construction project. They’re used on very large projects requiring a high volume of materials.

- Site improvement bonds, like right-of-way bonds and on-site improvement bonds, protect municipalities and taxpayers from contractor failure to complete improvement projects.

- Subdivision bonds serve as a developer’s guarantee that public improvements will be completed within the terms of the contract.

Because the construction industry runs on contracts, bonds are a very common way to manage risk in construction.

Commercial bonds

Commercial surety bonds are the most common type of bond. They’re typically required by legal or regulatory guidelines. In the public sector, they’re required by law for most government projects. In other industries, associations or other governing bodies may dictate bonding requirements.

Some common types of commercial bonds are:

- Import/export bonds guarantee compliance with customs laws for businesses that engage in importing or exporting goods.

- Freight broker bonds are required by the Federal Motor Carrier Safety Administration for businesses that ship goods across state lines.

- Tax bonds are required by federal, state, or local government entities to guarantee the payment of taxes, including sales tax, income tax, and payroll taxes.

- Court/legal bonds are required by a court to ensure that a party complies with legal obligations.

These are just some of the types – commercial bonding is a broad category that encompasses many different types of bonds in a variety of industries.

How contract bonds help you grow your business

A contract bond program gives you the ability to bid on and secure government contracts. Even for a job that doesn’t require bonding, you might be required to secure a bondability letter or bid bond. These are part of the prequalification process and help the project owner weed out unqualified bidders.

Securing bonded contracts boosts your revenue and helps you grow by:

- Allowing you to bid on larger and more complex projects

- Improving your reputation

- Helping you build the company’s financial strength and generational wealth

What bonding capacity is and how to increase it

Bonding capacity is the maximum amount a surety will cover. There are two types of capacity, known as the single-job limit and the aggregate limit. The single-job limit is the largest amount the surety will guarantee on one project. The aggregate limit is the total amount of work, across projects, that the surety will back at one time.

Factors influencing bond capacity

The bond company determines your capacity using many factors. Underwriters use financial signs like revenue, net worth, liquidity, and debt levels to determine a principal’s bonding capacity.

Non-financial factors can also impact your capacity. For example, your business’s track record, experience on similar projects, and level of organization can boost underwriters’ confidence in your ability to execute the project well.

How to increase your surety capacity

The best way to increase your surety capacity is to provide timely, accurate financial information to your underwriter. Leaving your surety carrier guessing does not build confidence. Provide frequent updates to show that your company is organized, transparent, and on a positive trajectory.

Need help to increase your capacity to win bigger jobs? Our in-house bond experts can perform a balance sheet analysis to help you make the best bonding decisions.

How to get a surety bond

The bond process typically follows these steps:

- Determine which type of bond you need. This might be clearly spelled out in your contract – if not, your insurance agent can help you figure it out.

- Select a reputable bond company. We recommend an A-rated carrier with experience in your industry.

- Application and approval. A bond application requires financial information and credit history. Typically, the bond provider will run a credit check during the underwriting process. They’ll assess the risk involved, and approve or reject your application.

- Payment. The premium is due when the bond is approved and goes into effect.

If you’re a POWERS client, our professional surety bond producer will help you through the whole bonding process, from choosing the right bond to approval.

How much does a surety bond cost?

The cost of a bond is a percentage of the final contract price. The percentage is based on rates filed with the state insurance department, usually ranging from around 1-4%. Your financial standing, credit score, and other factors go into your bond calculation.

Because the cost of a project usually fluctuates, your bond premium will be adjusted based on the final contract price.

Who pays for a surety bond?

The principal pays the premium for a surety bond. The premium payment is due upon the execution of the bond and underlying contract. If a claim occurs, the surety pays up front for the project costs up to the contracted amount. Then, the principal must reimburse the surety for those costs.

What happens if your business defaults on a contract bond

If you default on a surety bond, the obligee will file a claim with your surety. The surety will conduct an investigation to see if the claim is valid. If it is, the surety will act according to the details of the bond.

In case of contractor default, the surety’s actions vary depending on the type of bond and could include:

- Completing the contract according to specifications

- Making sure suppliers and subcontractors are paid

- Repairing defective work

Most bonds include an indemnity agreement that the principal is still financially liable for all these actions and must repay the bond company.

Grow your business with a better bond strategy

Bonds might be a cost of doing business, but with an expert on your side, you can use them to your advantage.

Cultivating the business you’ve worked hard to build is about more than bond compliance. It’s about increasing your bond capacity to win bigger contracts and steadily increase your revenue over time.

When you partner with POWERS, our in-house bond experts will help you identify opportunities to strengthen your business with bonds.

To discover how bonds can fuel your growth, schedule your free consultation today.