In 1992, Stella Liebeck sued McDonald’s after suffering severe burns from a cup of coffee she bought in a drive-thru. Many people think of this landmark case as egregious, but you might not know that Ms. Liebeck’s injuries left her permanently disfigured.

The court agreed that the coffee was negligently hot, sparking public discourse around liability and a business’s responsibility to protect customers.

General liability insurance protects your business in scenarios like this one – and a wide variety of others. Who needs a general liability policy and what does it cover?

In this guide, we’ll explore:

- What is general liability insurance?

- What does general liability cover?

- Who needs general liability insurance?

- How much does general liability insurance cost?

- How safety programs impact your general liability insurance

- How to get general liability coverage

- The general liability claim process: What to expect

- Get the general liability coverage you need from a partner you trust

What is general liability insurance?

Commercial general liability insurance protects your business from financial losses caused by accidents, injuries, or property damage. It’s one of the most common types of business insurance.

Your general liability insurance policy provides financial protection from the impact of these incidents and mitigates reputational risk.

What does general liability cover?

General liability insurance covers claims of injuries or damage caused by your business. The main types of damage covered by general liability are:

- Damage to someone’s property: Customer property damage, coverage for damages to subcontractors or other third parties property

- Bodily injury: Customer injuries or other third-party injuries

- Personal injury: Includes personal harm such as reputation damage or financial loss

- Advertising injury: Protection against claims of libel or slander

If you file a claim against your CGL policy, it can cover a wide range of expenses, including:

- Legal expenses such as attorney and other legal defense costs

- Medical expenses for third parties with bodily injury claims

- Property damage to third parties

- Settlements and judgments

What isn’t covered by general liability insurance?

There are a few things excluded from general liability coverage, including:

- Auto accidents covered by commercial auto

- Employee injuries and illnesses covered by workers’ comp

- Damage to your business property is covered by property insurance

- Professional mistakes covered by E&O

- Intentional damage and illegal activities by employees

What is and isn’t covered can vary, so it’s important to be familiar with your specific policy details. At POWERS, we go through a thorough assessment with all clients to ensure the policies they buy fit the risk they face.

Extending your general liability coverage

Businesses in some industries may find value in adding an extension endorsement to their GL policy for additional protection. Some common general liability extension endorsements include:

- Miscellaneous additional insureds: Common for independent contractors and business-to-business relationships

- Expanded personal and advertising injury: Common for professional service providers

- Liquor liability extension: Common for businesses hosting events and incidental liquor sales

- Legal liability and borrowed equipment: Common for contractors who rent equipment

Additional policies that complement general liability

In addition to GL insurance, we recommend including a variety of other types of coverage in your integrated risk management plan. These policies give you an extra layer of protection.

- Workers’ compensation: Covers medical expenses and lost wages for employees injured at work

- Professional liability insurance: Covers errors and omissions in professional services

- Commercial property insurance: Covers damage to property owned by your business

- Commercial auto insurance: Covers vehicles used for business purposes

Who needs general liability insurance?

Nearly every type of business, regardless of size or industry, needs general liability insurance. Even small businesses with just a few employees can be sued for accidents or bodily injuries that occur at their business location or from their completed products and operations. That’s why it’s important to have GL insurance in place, no matter how big or small your business is.

For example, if a customer slips on an unmarked wet floor in your restaurant, you could be held liable for their injuries because your negligence caused the incident.

Even if your business doesn’t have a physical location, you need protection against claims of personal or advertising injury.

If you’re unsure whether GL is right for your business, consider working with a risk advisor to perform a comprehensive exposure analysis for your business. You might be exposed to risk you haven’t considered.

General liability insurance for small business

Small businesses can be just as at-risk as large corporations. In fact, they can actually stand to lose more: Legal action can bankrupt a small business, while a large company can absorb the cost. General liability provides basic protection that helps business owners rest easy.

How much does general liability insurance cost?

Insurance carriers calculate your general liability premium using several factors, such as:

- Industry

- Business size

- Coverage limits and deductibles

- Claims history

- Risk management practices

Because insurance rates can vary, it’s important to work with a risk manager to find the best solution. Businesses with complex risk profiles will find the most value from partnering with an independent insurance agent that will help them proactively manage risk for long-term success.

More on the benefits of integrated risk management. >

How safety programs impact your general liability insurance

A strong workplace safety program can reduce your risk of incidents and claims – and therefore, lower your insurance premiums. Working with a safety education expert to develop consistent policies and procedures has a variety of other benefits, too, like:

- Reducing employee and customer injuries

- Reducing property damage from incidents

- Increasing employee retention

- Improving productivity and efficiency

- Boosting your company’s goodwill and reputation

How to get general liability coverage

An experienced agent should recommend insurance policies for you based on your business’s unique exposures and risk profile. If your agent hasn’t recommended GL but you think it could be a good fit, ask about it.

Your agent will find the best options based on your risk assessment and present them to you. At POWERS, we cover the following questions when presenting clients with coverage options:

- Does the pricing match the client’s expectations?

- Does the policy have the appropriate limits, deductibles, and coverage enhancement endorsements?

- What are the carrier’s financial stability, reputation, and claims process like?

- What added value can the carrier offer the client – e.g. legal resources and medical-only claims?

At POWERS, we work with some of the best business insurance carriers in the U.S. There’s no need to spend hours researching providers – we’ll make recommendations tailored to your business.

I truly believe these guys are looking out for your best interest and have complete faith and trust in the care they put into what they do for you, researching rates, getting the best coverage for you.

Kraig H. (current client)

The general liability claim process: What to expect

If you need to file a general liability claim, don’t panic. Thousands of claims are filed every day.

The claim process is different for every carrier and agency, so we recommend learning your insurance agent’s process before you need to file a claim. That way, you’re prepared when the time comes.

Here’s the claim process for POWERS clients:

- Contact your POWERS account manager or claims handler before you call the insurance carrier.

- A POWERS expert will provide a claim consultation to help you evaluate the severity of the claim, your deductible level, contractor referrals, and what to expect going forward.

- With your approval, your account manager will submit the claim to the carrier on your behalf. In some cases, you might choose not to file a claim.

- We’ll pass along your claim number and your adjuster’s contact info.

- You’ll work directly with your adjuster to provide relevant evidence, like police reports, medical records, and photographs of the damage.

- If your claim is covered, the carrier will offer a settlement amount to the claimant or provide a defense if a lawsuit is filed against you.

- The claim will be resolved through a settlement agreement or a court decision.

During this process, your POWERS claims consultant will be with you every step of the way.

Get the general liability coverage you need from a partner you trust

Most businesses need general liability, but how can you make sure you get the right coverage and the most value from your policy? Who will guide you through the claims process when an incident happens?

Any agent can write you a policy. But you don’t need any agent – you need a business partner with proven risk control expertise.

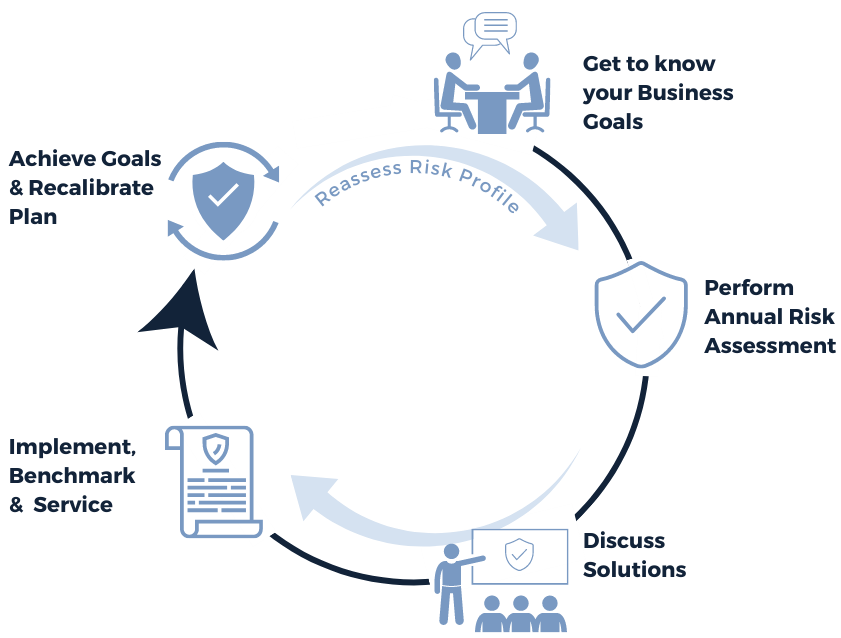

At POWERS, we spent more than 30 years developing what we call “the POWERS Process.” We use this five-step framework to get a deep understanding of your business and make recommendations that not only give you the right insurance coverage, but also help you make smart decisions to grow your business.

We know from decades of experience that a one-size-fits-all approach to risk management simply doesn’t work. We’ll take you through a series of discussion points to drill down and uncover exposures you’ve never considered. Then, we’ll build a plan to safeguard your business and look toward the future.

Schedule your 30-minute consultation today. >

| Anonymous Agency | POWERS |

| Insurance as a stand-alone product | Insurance integrated into your customized risk management plan |

| Multiple, run-of-the-mill applications to assess your risk | Customized, proprietary assessment for a deep understanding of your risk |

| Focused on up-front cost savings | Focused on long-term cost control |

| Salespeople who write your policy and ghost you until renewal | Partners who help you make smart, growth-focused business decisions |

| Say they care about your business’s success | Show you we care by setting your risk management plan in motion |