Keith Goode

CLCS

With expertise in:

- Hospitality

How Can I Help You Today?

"*" indicates required fields

Risk Management Guidance with Insurance Solutions

High expertise in the following areas

Keith's Bio

Partner with Keith

Any agency can sell you an insurance package. But sustainable business growth isn’t just about insurance. It’s about controlling risk and protecting what you’ve built.

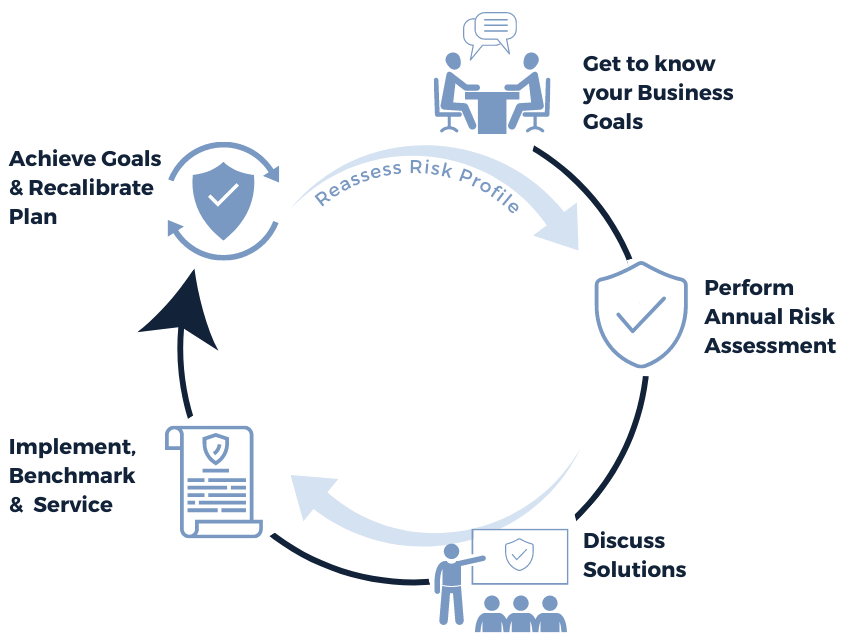

Integrated risk management helps you make better business decisions by incorporating risk-aware practices, processes, and technologies into your operations.

When you partner with POWERS, you get dedicated risk experts on your team. Together, we’ll develop a complete risk management plan based on your unique risks and goals.

Then, we’ll help you put your plan into action and measure your success using our POWER