Mark Sherman

LUTCF

Personal Lines Practice Leader with expertise in:

- $1MM + Homes

- Second Homes

- Collections/Valuables

- Luxury Autos

How Can I Help You Today?

Insurance solutions to protect your lifestyle

High expertise in the following areas

Marks' Bio

Mark has over two decades of experience in the insurance industry, where his passion lies in educating clients on protecting the assets they’ve worked hard to build. He began his career with a deep commitment to helping clients navigate the complexities of home, auto, umbrella, and life insurance, always striving to find the best coverage and pricing options available. Beyond his client work, Mark is dedicated to mentoring his team members, guiding them to grow and succeed in their roles.

Outside of work, Mark enjoys a vibrant family life with his wife Deanna, who is also an Account Manager at Powers Insurance & Risk Management, and their three amazing kids. In his spare time, you can find Mark walking, working out, or traveling with his family. His commitment to both his professional and personal life is evident in everything he does.

Partner with Mark

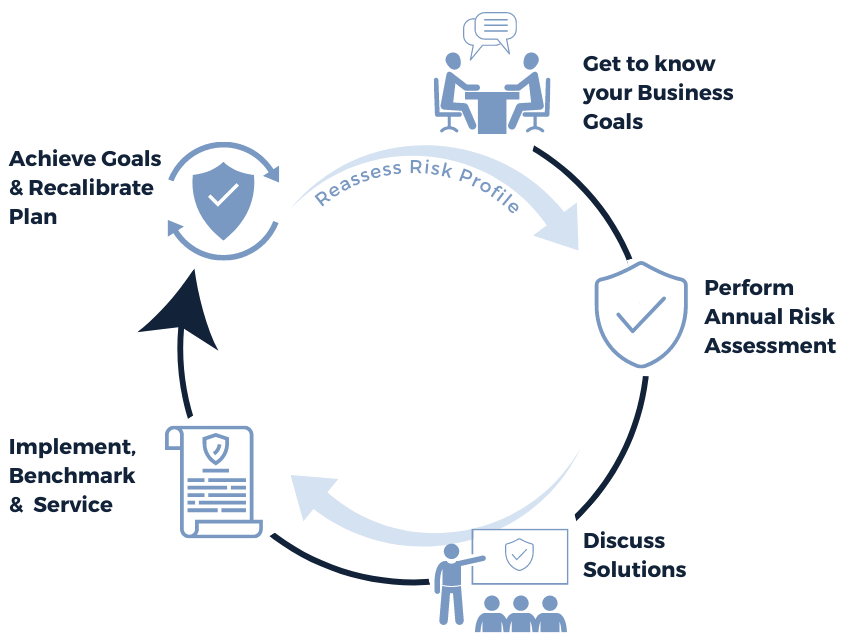

Any agency can sell you an insurance package. But sustainable business growth isn’t just about insurance. It’s about controlling risk and protecting what you’ve built.

Integrated risk management helps you make better business decisions by incorporating risk-aware practices, processes, and technologies into your operations.

When you partner with POWERS, you get dedicated risk experts on your team. Together, we’ll develop a complete risk management plan based on your unique risks and goals.

Then, we’ll help you put your plan into action and measure your success using our POWER